Good news: B2B prospecting data is more accurate than you may think.

Business marketers are always complaining about their customer data. “It’s pretty bad,” they’ll say. “It’s a mess.” Over the last decade, my colleague Bernice Grossman and I have studied this issue, producing a series of five research reports on the quality of the data B2B marketers can rent or buy for prospecting purposes. Our latest study published this week shows that prospecting data is surprisingly accurate—well over 90%. We actually verified the accuracy by outbound phone, thanks to the call center at PointClear.

In past studies, our focus has been on both data quantity and quality, with the goal of giving marketers a sense of how likely they will be to reach all the prospects they want, with minimal waste, using the prospecting data provided by U.S. vendors today.

We were generally satisfied with the method we used to get at data quantity, where we asked vendors to provide company counts in specified sample industries and contact counts at specified sample companies.

But when it comes to data quality, we have long wished for a better method of verifying the accuracy of the company records provided by data vendors. Fortunately, an opportunity arrived with a generous offer from Dan McDade of PointClear to televerify the data samples. PointClear provides lead generation and management services, and houses a sophisticated and efficient call center run by Karla Blalock.

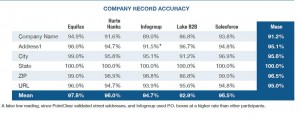

So we invited vendors of B2B prospecting data to participate, and we structured a research study to get at the accuracy of a statistically projectable sample of company records from the vendors. The five participants who agreed and contributed a data sample, are Equifax, Harte Hanks, Infogroup, Lake B2B, and Salesforce. Our sincere thanks to them all. (Harte Hanks has since sold its prospecting data business.)

The televerification process took place immediately on receipt of the names, but the analysis was more complex than we expected. Eventually, the skilled analyst David Knutson generously volunteered to work on the research data for us.

Methodology and process

We asked the vendors to supply records as follows:

- All firms located in PA, GA, WI, OH, CO, with $25+ million revenue, HQ locations only.

- Company name, address, URL.

We planned to televerify firms that were common to all five participants. PointClear conducted a merge, and called the common companies in random order, stopping when 103 companies had been contacted successfully. The televerification took place during the period of August 28 to September 15, 2014.

The research results

Having asked for all headquarters sites of $25+ million revenue companies in five states, we found the company-level data to be generally accurate, above 90%.

Overall accuracy by vendor ranged from 92.9% to 97.8%. When looking at the accuracy by data element, company name was the most likely to be inaccurate, at 91.2% overall. There were some minor (less than 5%) accuracy problems with the street address, zip codes, and URLs. The state data reports at a perfect 100% because the companies were selected on a state level.

Marketers can feel fairly comfortable that the prospecting data they get from vendors is likely to be reasonably accurate when it comes to company names, postal addresses, and URLs.

Advice to business marketers ordering prospecting names

B2B marketers should be prepared for a certain number of errors, due to the inherent limitations of merge/purge software, and software variations among vendors. Business addresses are complicated, with variations like P.O. box versus street address; headquarters versus divisions and subsidiaries; and legal name versus trade name. Marketers need to examine how their vendors maintain data at the company level, and then specifically ask for data to be pulled the way they want it.

Other suggestions for marketers to consider:

- Take a sample of records for testing and do your own televerification before placing a large order.

- Examine the incoming records for problems.

- Use a trusted list broker who has a thorough knowledge of the particular vendor’s file.

We hope our research is useful to business marketers who are renting or buying data for finding new prospective accounts. The data may be a lot more accurate than you expect.