The Federal Savings and Loan Insurance Corporation (FSLIC) crisis during the 1980s and early 1990s was one of the most significant financial crises in the United States. The crisis resulted in the collapse of several hundred Savings and Loan Associations, which led to the insolvency of the FSLIC and its takeover by the FDIC and the creation of the Resolution Trust Corporation (RTC). The crisis was a result of various factors, including poor regulatory oversight, fraudulent financial practices, and the erosion of the value of assets held by Savings and Loan Associations. The failure of so many of these banks also highlighted the importance of duration and convexity in managing balance sheet interest rate risks. Let’s review how these concepts were relevant during the FSLIC crisis, and how they compare to today’s banking environment when the yield curve is inverted.

Duration

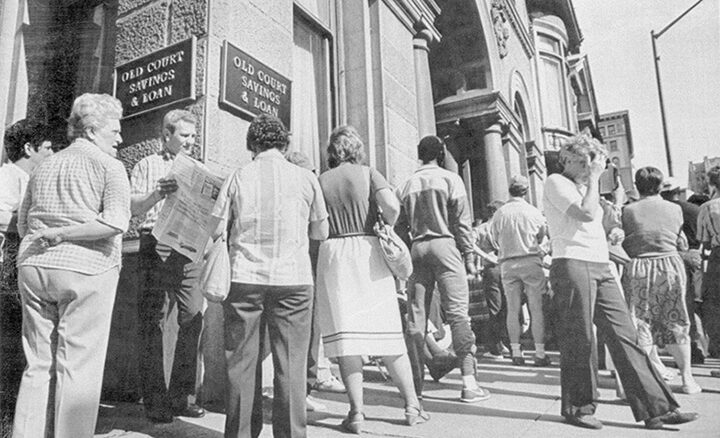

Duration is a measure of the degree that time plays on the change of the price of a financial instrument, for example, a bond, or a mortgage, to changes in interest rates. If interest rates rise, the value of a bond portfolio will decrease, and if interest rates fall, the value will increase. The longer the duration, the more responsive is the change in the price of a financial instrument to changes in interest rates. To minimize interest risk, banks hedge (match) the duration of their assets and liabilities. The Savings and Loans bank failures were caused in part by a mismatch of the duration of the assets vs. that of the banks’ liabilities. The effected banks held long-term, fixed-rate mortgages, which had long durations. When interest rates rose in the late 1980s, the value of these mortgages decreased, and the banks suffered book (unrealized) losses. Moreover, to remain competitive, rates paid on demand deposits as well as short-term funding sources (very short duration) went up, reducing the profitability or the margin earned on the mortgages. As the mortgage portfolios were marked to market (revalued), capital adequacy ratios turned low or negative rendering the banks insolvent.

Silicon Valley Bank (SVB) faced a similar problem. The bank was substantially funded by large deposits (liabilities) which in periods of low to no interest rates provided a cheap source of capital. These liabilities had very short duration. The bank then invested those deposits in medium-term treasuries and other financial instruments that had long duration. This all worked fine while the yield curve was sloping upwards[1]. Once the Fed started increasing interest rates, the value of the assets (long duration) decreased rapidly without a corresponding decrease in the value of the short-duration liabilities. The bank found itself needing to raise significant amounts of capital to stay solvent, an effort that failed.

Convexity

Convexity, is a measure of the degree of change in duration due to changes in interest rates. Namely, it indicates the sensitivity of the value of a financial instrument or portfolio of financial instruments to various changes in interest rates levels. It is particularly relevant in terms of the impact on the value of a financial instrument when there are large interest rate changes like the ones we have experienced since the Fed began increasing interest rates. Simply matching the duration of assets and liabilities is not a guaranteed hedge if convexity is different. In the context of SVB and the FSLIC crisis, not only the duration, but the convexity of the assets, when compared to that of the liabilities, may have played a critical role in accelerating their collapse.

An inverted yield curve[2] on the one hand, with Fed tightening on the other, highlight the importance of duration and convexity in managing balance sheet interest rate risk. The Federal Reserve lowered interest rates to near-zero levels in response to the COVID-19 pandemic, which led to a surge in the prices of fixed-priced financial instruments. Once the Fed changed course to rapid tightening, values decreased, with the losses more significant for those with higher duration and convexity. For banks who did not hedge this exposure by matching the duration and convexity of their assets and liabilities, this has again proven to be detrimental.

In conclusion, companies need to understand and manage interest rate risks. The FSLIC crisis of the 1980s and early 1990s highlighted the importance of duration and convexity in managing bank balance sheet interest rate risk. The failure of SVB is a reminder of the importance of these measurements and implementation of hedging techniques particularly during periods of large increases in rates, and inverted yield curve.

[1] The yield curve is the measure of the comparative interest rates of financial instruments of various maturities at a single point in time, generally expressed graphically over a period of time on the X axis from shortest to longest, with the Y axis representing the yield in percentage terms. An upward sloping yield curves is considered “normal” with longer term maturing instruments bearing a greater interest rate that shorter term instruments, due to the perceived risk in holder longer term instruments.

[2] An inverted yield curve is one in which the yield on longer term instruments is lower than shorter term instruments and has often led up to an economic slowdown.

This article was originally published on 2GO Advisory Group’s blog.